theSCHEDULE INFORMATION (Amendment☐☒ Preliminary Proxy Statement ☐Forfor Use of the Commission Only (as permitted by Rule☒☐ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Under Rule 14a-12Pursuant to PriceSmart, Inc.In Itsin its Charter)other thanOther Than the Registrant)the appropriate box)all boxes that apply):☒ No fee required. ☐ Fee paid previously with preliminary materials. ☐

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1. Title of each class of securities to which transaction applies:

2. Aggregate number of securities to which transaction applies:

|

4. Proposed maximum aggregate value of transaction:

5. Total fee paid:

☐ Fee paid previously with preliminary materials.

|

1. Amount Previously Paid:

2. Form, Schedule or Registration Statement No.:

3. Filing Party:

4. Date Filed:

2020 PROXY STATEMENT

FOR 2024

ANNUAL MEETING OF STOCKHOLDERS

PRICESMART, INC.

9740 Scranton Road

San Diego, California 92121

PRICESMART, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS AND PROXY STATEMENT

TO THE STOCKHOLDERS OF PRICESMART, INC.:

Notice is hereby given that the Annual Meeting (the “Annual Meeting”) of the Stockholders of PriceSmart, Inc. (the “Company”), will be held at 10:008:30 a.m. P.S.T.C.S.T. on Thursday, February 4, 2021. As a result of the public health and travel risks and concerns due to the COVID-19 pandemic, the1, 2024. The Annual Meeting will be held via live audio webcast on the internet. You will be able to participate, vote and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/PSMT2021.PSMT2024. You will not be able to attend the Annual Meeting physically. The Annual Meeting will be held for the following purposes:

| 1. | To elect directors for the ensuing year, to serve until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified. The Board of Directors of the Company has nominated and recommends for election as directors the following |

Sherry S. Bahrambeygui | Beatriz V. Infante | David N. Price | John D. Thelan | |||

Jeffrey Fisher | Leon C. Janks | Robert E. Price | ||||

Gordon H. Hanson | Patricia Márquez | |||||

| David R. Snyder |

| 2. | To approve, on an advisory basis, the compensation of the Company’s executive officers for fiscal year |

| 3. | To approve, |

| 4. | To approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to provide for the limitation of liability of officers of the Company as permitted pursuant to a recent amendment to the General Corporation Laws of Delaware (“DGCL”); |

| 5. | To ratify the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending August 31, |

To transact such other business as may be properly brought before the Annual Meeting or any adjournment thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. The Board of Directors has fixed the close of business on December 7, 20204, 2023 as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. A list of such stockholders shallwill be open to the examination of any stockholder for a period of ten days prior to the date of the Annual Meeting at the Company’s corporate headquarters, 9740 Scranton Road, San Diego, California 92121. During the Annual Meeting, any stockholder attending the Annual Meeting may access a list of the stockholders entitled to vote at the Annual Meeting at www.virtualshareholdermeeting.com/PSMT2021.PSMT2024.

Accompanying this Notice is a Proxy.proxy or voting instructions card. WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE SIGN AND DATE THE ENCLOSED PROXY OR VOTING INSTRUCTION CARD AND RETURN IT PROMPTLY, OR YOU MAY VOTE YOUR SHARES BY TELEPHONE OR OVER THE INTERNET, AS DESCRIBED IN THE ENCLOSED PROXY.PROXY OR VOTING INSTRUCTION CARD. If you plan to attend the Annual Meeting and wish to vote your shares personally, you may do so at any time before the Proxyproxy is voted.

All stockholders are cordially invited to attend the meeting.meeting via the webcast.

BY ORDER OF THE BOARD OF DIRECTORS

Francisco J. Velasco

Secretary

San Diego, California

December 18, 202019, 2023

PRICESMART, INC.

9740 Scranton Road

San Diego, California 92121

PROXY STATEMENT

for

ANNUAL MEETING OF STOCKHOLDERS

February 4, 20211, 2024

The Board of Directors of PriceSmart, Inc., a Delaware corporation (the “Company”), is soliciting the enclosed Proxyproxies for use at the Annual Meeting of Stockholders of the Company to be held on February 4, 20211, 2024 (the “Annual Meeting”), and at any adjournments thereof. The Annual Meeting will be a virtual meeting via live audio webcast on the internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/ PSMT2021PSMT2024 and entering the 16-digit control number included in the Notice of Internet Availability or proxy card that you receive. For further information about the Annual Meeting, please see “Important Information about the Annual Meeting and Voting” beginning on page 3.

This Proxy Statement will be first sent to stockholders on or about December 18, 2020.19, 2023. You can submit your Proxyproxy by mail or you may provide voting instructions for your shares by telephone or via the internet. Instructions for voting by telephone, by using the internet or by mail are described on the enclosed Proxy.proxy card. If you plan to attend the virtual Annual Meeting and wish to vote your shares personally, you may do so. Unless contrary instructions are indicated on the Proxy,proxy, all shares represented by valid Proxiesproxies received pursuant to this solicitation (and not revoked before they are voted) will be voted for the election of the Board of Directors’ nominees for directors, or for a substitute or substitutes selected by the Board of Directors in the event a nominee or nominees are unable to serve or decline to do so; for the approval, on an advisory basis, of the compensation of the Company’s executive officers for fiscal year 2020;2023; for the approval, on an advisory basis, of the frequency of holding an advisory vote on executive compensation; for the approval of an increase in the number of shares of Common Stock available for the grant of awards undera proposed amendment to the Company’s 2013 Equity Incentive Award Plan, as amended;Amended and Restated Certificate of Incorporation to limit the liability of officers; and for the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending August 31, 2021.2024. As to any other business that may properly come before the Annual Meeting and be submitted to a vote of the stockholders, Proxies received by the Board of Directors will be voted in accordance with the best judgment of the holders thereof.

A Proxyproxy may be revoked by written notice to the Secretary of the Company at any time prior to the Annual Meeting by executing a later Proxyproxy or by attending the virtual Annual Meeting and voting in at the meeting.

The Company will bear the cost of solicitation of Proxies. In addition to the use of mails, Proxies may be solicited by personal interview, telephone, facsimile or e-mail, by officers, directors and other employees of the Company. The Company also will request persons, firms and corporations holding shares in their names, or in the names of their nominees, which are beneficially owned by others, to send, or cause to be sent, proxy material to, and obtain Proxies from, such beneficial owners and will reimburse such holders for their reasonable expenses in so doing.

The Company’s mailing address is 9740 Scranton Road, San Diego, California 92121.

Voting

Stockholders of record at the close of business on December 7, 20204, 2023 (the “Record Date”) will be entitled to notice of, and to vote at, the Annual Meeting or any adjournments thereof.

As of December 7, 2020, 30,738,334the Record Date, 30,516,876 shares of the Company’s common stock, $0.0001 par value per share (“Common Stock”), were outstanding, representing the only voting securities of the Company. Each share of Common Stock is entitled to one vote.

Votes cast by Proxyproxy or at the Annual Meeting will be counted by the person appointed by the Company to act as Inspector of Election for the Annual Meeting. The Inspector of Election will treat shares represented by Proxiesproxies that reflect abstentions or include “broker non-votes” as shares that are present and entitled to vote for purposes of determining the presence of a quorum.

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and | 1 |

Because directors are elected by a plurality of the votes of the shares present or represented by Proxyproxy at the Annual Meeting and entitled to vote on the election of directors, the teneleven director nominees who receive the greatest number of votes cast will be elected directors.

The non-binding advisory vote on executive compensation the proposed amendment to the Company’s 2013 Equity Incentive Award Plan, as amended, to increase the number of shares of Common Stock available for the grant of awards, and the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending August 31, 20212024 require the affirmative vote of a majority of the aggregate votes present, in person or by proxy, and entitled to vote on the matter at the Annual Meeting.

Abstentions The vote to approve an amendment to our Amended and broker non-votes are not included as votes cast and will not affectRestated Certificate of Incorporation to limit the outcomeliability of anycertain officers of the proposals. Broker non-votes occur whenCompany for damages due to breach of fiduciary duty of care requires the affirmative vote of a person holdingmajority of the outstanding shares of Common Stock as of the Record Date.

With regard to the non-binding advisory vote on the frequency with which the compensation of our executive officers will be subject to an advisory stockholder vote, the frequency (every one, two or three years) receiving the largest number of votes, even if not a majority, will be considered the preference of our stockholders. The Board of Directors recommends that stockholders vote for a frequency of every one year for the advisory vote regarding the compensation of our executive officers. However, because this vote is advisory and not binding on us in street name, such as throughany way, we may decide that it is in our and our stockholders’ best interests to hold an advisory vote on executive compensation more or less frequently than the preference expressed by our stockholders.

If you are a brokerage firm,beneficial owner of shares held in “street name” and do not provide the broker, bank, or other nominee that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote your shares on routine matters but cannot vote on non-routine matters. If the broker, bank or other nominee that holds your shares does not providereceive instructions as tofrom you on how to vote thoseyour shares on a non-routine matter, the organization that holds your shares will inform the election inspector that it does not have the authority to vote on this matter with respect to your shares. This is commonly referred to as a “broker non-vote.”

The election of directors (referred to as “Proposal 1”), the say-on-pay proposal (referred to as “Proposal 2”), the say-on-frequency proposal (referred to as “Proposal 3”) and the proposed amendment to the Company’s Amended and Restated Certificate of Incorporation to limit the liability of officers (referred to as “Proposal 4”) are matters considered non-routine under applicable rules. A broker, does not thenbank or other nominee cannot vote those shareswithout your instructions on non-routine matters; as a result, there may be broker non-votes on Proposals 1, 2, 3 and 4. For your vote to be counted on the stockholder’s behalf.above proposals, you will need to communicate your voting decisions to your broker, bank or other nominee before the date of the Annual Meeting using the voting instruction form provided by your broker, bank or other nominee.

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal 2024 (referred to as “Proposal 5”) is a matter considered routine under applicable rules. A broker, bank or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected in connection with Proposal 5.

Broker non-votes and abstentions each are counted for determining the presence of a quorum. The election of directors requires a plurality of votes cast. Neither broker non-votes nor any withhold votes in the election of directors will have any effect thereon. Because they represent shares present and entitled to vote that are not cast in favor of a proposal, abstentions will have the same effect as votes “against” Proposal 2. Broker non-votes, however, do not represent shares present and entitled to vote on non-routine matters, and therefore, will have no effect on Proposal 2. In the case of Proposal No. 3, the non-binding advisory vote on the frequency with which the compensation of our executive officers will be subject to an advisory stockholder vote, the frequency (every one, two or three years) receiving the largest number of votes, even if not a majority, will be considered the preference of our stockholders. Neither abstentions nor broker non-votes will have any effect. The amendment of the Amended and Restated Certificate of Incorporation requires the approval of a majority of the outstanding shares of Common Stock. As a result, abstentions and broker non-votes will have the same effect as votes “against” Proposal 4.

| 2 | PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and |

Important Information Aboutabout the Annual Meeting and Voting

Why Is the Company Soliciting My Proxy?

The Board of Directors is soliciting your proxy to vote at the Annual Meeting to be held at 10:008:30 a.m. P.S.T.C.S.T. on Thursday, February 4, 2021.1, 2024. The Annual Meeting will be held via live audio webcast on the internet. You will be able to participate, vote and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ PSMT2021.PSMT2024. You will not be able to attend the Annual Meeting physically. This Proxy Statement, along with the accompanying Notice of Annual Meeting of Stockholders, summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting.

We have made available to you on the internet or have sent you this Proxy Statement, the Notice of Annual Meeting of Stockholders, the Proxyproxy or voting instructions card and a copy of our Annual Report on Form 10-K for the fiscal year ended August 31, 20202023 because you owned shares of PriceSmart, Inc. Common Stock on the Record Date. This Proxy Statement will be first sent to stockholders on or about December 18, 2020.19, 2023.

Why are you holding a Virtual Annual Meeting?

Due to the continuing public health impact of COVID-19 and to support the health and well-being of our stockholders, theWe believe that a virtual Annual Meeting will be held in a virtual meeting format only. We have designed our virtual format to enhance, rather than constrain,provides expanded stockholder access and participation and communication. For example, the virtual format allows stockholders to communicate with us in advance of, and during, the Annual Meeting so they can ask questions of our Chairman or Chief Executive Officer, as time permits. It is the present expectation of the Board of Directors that future annual meetings will have an in-person format.improved communications.

How Do I Vote?

Whether you plan to attend the Annual Meeting virtually or not, we urge you to vote by proxy. If you vote by proxy, the individuals named on the Proxy,proxy, or your “proxies,” will vote your shares in the manner you indicate. For example, you may specify whether your shares: should be voted for or withheld for each nominee for director; should be voted for, against or abstained with respect to the approval, on an advisory basis, of compensation of the Company’s named executive officers; should be voted for one year, two years, three years or abstain with respect to the approval, on an advisory basis, of the frequency of holding an advisory vote on executive compensation; should be voted for, against or abstained with respect to approval of the proposed amendment to the Company’s 2013 Equity Incentive Plan;Amended and Restated Certificate of Incorporation to limit the liability of officers; and should be voted for, against or abstained with respect to the ratification of the appointment of the Company’s independent registered public accountant, as disclosed in this Proxy Statement. Voting by proxy will not affect your right to attend the Annual Meeting.Meeting virtually. If your shares are registered directly in your name through our transfer agent, or you have stock certificates registered in your name, you may submit a proxy to vote:

| • | By internet or by telephone. Follow the instructions attached to the |

| • | By mail. If you received one or more |

| • | At the virtual meeting. You may vote your shares electronically through the portal at the Annual Meeting (if you satisfy the admission requirements, as described below). Even if you plan to attend the Annual Meeting virtually, we encourage you to vote in advance by telephone, through the internet or by mail so that your vote will be counted in the event you later decide not to attend. |

The Annual Meeting will be a virtual meeting of stockholders conducted via a live audio webcast that provides stockholders the same rights and opportunities to participate as they would have at an in-person meeting. We believe that a Annual Meeting will provide expanded stockholder access and participation and improved communications. You will be able to vote your shares

Important Information About the Annual Meeting and Voting (continued)

electronically at the Annual Meeting. To attend and submit your questions during the Annual Meeting, please visit www.virtualshareholdermeeting.com/PSMT2021.PSMT2024. To participate and vote during the Annual Meeting, you will need the 16-digit control number included on your Notice of Internet Availability or on your Proxy.proxy card. Beneficial stockholders who do not have a

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement | 3 |

Important Information About the Annual Meeting and Voting

(continued)

control number may gain access to and vote at the meeting by logging in to their broker, brokerage firm, bank or other nominee’s website and selecting the stockholder communications mailbox to access the meeting; instructions should also be provided on the voting instruction card provided by your broker, bank, or other nominee. If you encounter any difficulties accessing the Annual Meeting during check-in or the meeting, please call the technical support number that will be posted on the virtual stockholder meeting log-in page.

What happens if there are technical difficulties during the Annual Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting, voting at the Annual Meeting or submitting questions at the Annual Meeting. If you encounter any difficulties accessing the Annual Meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual stockholder meeting log-in page.

Is Voting Confidential?

We will keep all the Proxies, ballots and voting tabulations private. We only let our Inspector of Election and our Secretary examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make on the Proxyproxy card or otherwise provide.

Attending the Annual Meeting

This year, the Annual Meeting will be held in a virtual meeting format only. To attend the Annual Meeting, go to www.virtualshareholdermeeting.com/PSMT2021PSMT2024 shortly before the meeting time, and follow the instructions for downloading the webcast. You need not attend the Annual Meeting in order to vote.

| 4 | PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and |

Proposal 1Election of Directors

Based on the recommendation of the Nominating/Corporate Governance Committee, the Board of Directors of the Company has nominated and recommends for election as directors the teneleven persons named herein to serve until the next Annual Meeting of Stockholders and until their respective successors shall have been duly elected and qualified. In accordance with the Company’s Second Amended and Restated Bylaws, the size of the Board will be increased from nine to ten members immediately prior to the Annual Meeting pursuant to a resolution adopted by the Board. Following the Annual Meeting, there will be no vacancies on the Board. Each of the nominees has consented to serving as a nominee and being named as a nominee in this Proxy Statement and to serving as a director if elected. Directors are elected by a plurality of the votes of the shares present in person or represented by Proxyproxy at the Annual Meeting and entitled to vote on the election of directors. The enclosed Proxyproxy card will be voted in favor of the persons nominated unless otherwise indicated. If any of the nominees should be unable to serve or should decline to do so, the discretionary authority provided in the Proxyproxy card will be exercised by the proxy holders to vote the shares represented by the Proxiesproxies for one or more substitute nominees selected by the present Board of Directors. The Board of Directors does not believe at this time that any substitute nominee or nominees will be required.

Nominations Process

Identification and Evaluation of Nominees for Directors

The Nominating/Corporate Governance Committee identifies nominees for director by first evaluating the current members of our Board of Directors willing to continue in service. Current members with qualifications and skills that are consistent with the Nominating/Corporate Governance Committee’s criteria for board service, as set forth in the section below entitled “Director Qualifications,” and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of our Board of Directors with that of obtaining a new perspective.

If any member of the Board of Directors does not wish to continue in service or if the Board of Directors decides not to re-nominate a member for re-election, the Nominating/Corporate Governance Committee identifies the desired skills and experience of a new nominee in light of the criteria set forth below in “Director Qualifications.” The Nominating/Corporate Governance Committee generally consults with other members of the Board of Directors and may seek input from management, independent counsel, industry experts or advisors that the Nominating/Corporate Governance Committee believes to be desirable and appropriate. The Nominating/Corporate Governance Committee reviews the qualifications, experience and background of any candidates who are identified. Final candidates are interviewed by the members of the Nominating/Corporate Governance Committee. In making its determinations, the Nominating/Corporate Governance Committee evaluates each individual in the context of the Board of Directors as a whole, with the objective of assembling a group that can best perpetuate the success of the Company and represent stockholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the Nominating/Corporate Governance Committee makes its recommendation to the Board of Directors.

Pursuant to the Nominating/Corporate Governance Committee Charter, stockholders of the Company who have held shares of the Company’s Common Stock for at least one year and who hold a minimum of 1% of the Company’s outstanding shares of Common Stock may suggest a candidate for director by writing to the Secretary of the Company. In order to be considered, the recommendation for a candidate must include the following written information: (1) a detailed resume of the recommended candidate; (2) an explanation of the reasons why the stockholder believes the recommended candidate is qualified for service on the Board of Directors; (3) such other information that would be required by the rules of the SEC to be included in a proxy statement; (4) the written consent of the recommended candidate; (5) a description of any arrangements or undertakings between the stockholder and the recommended candidate regarding the nomination; and (6) proof of the recommending stockholder’s stock holdings in the Company. In addition, we may require any candidate to furnish such other information as may reasonably be required by the Company to determine the eligibility of such candidate to serve as an independent director in accordance with the Company’s corporate governance guidelinesCorporate Governance Guidelines or that could be material to a reasonable stockholder’s understanding of the independence or lack of independence of such candidate. In order to give the Nominating/Corporate

Proposal 1 Election of Directors (continued)

Governance Committee sufficient time to evaluate a recommended candidate and/or include the candidate in the Company’s proxy statement for the annual meeting to be held in 2022,2025, the recommendation should be received by the Secretary of the

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement | 5 |

Proposal 1 Election of Directors (continued)

Company at the Company’s principal executive offices nonot later than August 20, 2021.the close of business on the 90th day, nor earlier than the close of business on the 120th day, prior to February 1, 2025, the one-year anniversary of the 2024 Annual Meeting. In the event that the Company receives director candidate recommendations from stockholders, those recommendations are evaluated in the same manner that potential nominees suggested by Board members, management or other parties are evaluated. The Company does not intend to treat stockholder recommendations in any manner different from other recommendations.

Director Qualifications

In evaluating director nominees, the Nominating/Corporate Governance Committee considers, among other things, the following factors:

| • | personal and professional integrity, ethics and values; |

| • | experience in corporate management, such as serving as an officer or former officer of a publicly held company, and a general understanding of marketing, finance and other elements relevant to the success of a publicly traded company in today’s business environment; |

| • | experience in the Company’s industry and with relevant social policy concerns; |

| • | experience as a board member of another publicly held company; |

| • | academic or professional expertise in one or more aspects of the Company’s current or planned operations; and |

| • | practical and mature business judgment, including ability to make independent analytical inquiries. |

Our Corporate Governance Guidelines require all director nominees to be less than 80 years of age upon election to the Board and to retire from the Board upon reaching the age of 80; provided, however that if a director reaches the age of 80 during his or her one-year term, he or she may continue to serve until the conclusion of that one year term. Robert Price turned 80 in August 2022. After considering Mr. Price’s historic and ongoing contributions to the Board and the Company, the Board of Directors has waived the application of the age limit to Mr. Price.

While the Company does not have a specific policy regarding board diversity, in connection with its evaluation of director nominees, the Nominating/Corporate Governance Committee also considers diversity of expertise and experience in substantive matters pertaining to our business relative to other members of the Board of Directors. The Nominating/Corporate Governance Committee also considers diversity of background (including diversity of gender, race and ethnicity) and life experience. The Board of Directors and Nominating/Corporate Governance Committee are committed to actively seeking highly qualified women and individuals from minority groups to include in the pool from which new candidates are selected. The Nominating/Corporate Governance Committee’s objective is to assemble a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience.

The Board of Directors does not believe that directors should expect to be re-nominated annually. In determining whether to recommend a director for re-election, the Nominating/Corporate Governance Committee considers the director’s participation in and contributions to the activities of the Board of Directors, the results of the most recent Board evaluation and meeting attendance.attendance, among other factors.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Nominating/Corporate Governance Committee may also consider such other facts as it may deem are in the best interests of the Company and its stockholders. The Nominating/Corporate Governance Committee also believes it is appropriate for at least one, and, preferably, several, members of the Board of Directors to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of the Board of Directors be independent as required under the Nasdaq Stock Market listing standards applicable to the Company. The Nominating/Corporate Governance Committee also believes it is appropriate for the Company’s chief executive officer to serve as a member of the Board of Directors. Directors’ performance and qualifications are reviewed annually by the Nominating/Corporate Governance Committee.

| 6 | PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement |

Proposal 1 Election of Directors (continued)

A copy of the Nominating/Corporate Governance Committee Charter is available on the Company’s public website at www.pricesmart.com.investors.pricesmart.com.

Director Skills and Board Diversity Matrix

The Nominating/Corporate Governance Committee and Board regularly review the skills and experiences relevant to our Board. Depending on the current composition of the Board and Board committees and expected future turnover on our Board, the Nominating/Corporate Governance Committee generally seeks director candidates with experience, skills, or background in one or more of the following areas:

| • | Retail Experience — experience as an officer or director of, or advisor to, one or more retail companies with an understanding of financial, operational and strategic issues facing large retail companies |

| • | Technology or eCommerce Experience — experience relevant to the development and uses of technology as well as eCommerce, omni-channel and digital businesses |

| • | Global or International Business Experience — experience at multinational companies or in international markets |

| • | Marketing or Brand Management Experience — experience in consumer marketing or brand management, especially on a global basis |

| • | Senior Leadership Experience — experience serving in relevant senior leadership positions managing governance, strategy, development, human capital management, workforce development and execution |

| • | Regulatory, Legal or Risk Management Experience — experience with public policy, legal and regulatory matters, and risk management |

| • | Finance, Accounting or Financial Reporting Experience — experience with finance, accounting, financial reporting and/or audit processes |

| • | Cybersecurity — experience in the development of technology and processes that protect the storage of information and maintain confidentiality |

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and | 7 |

Proposal 1Election of Directors (continued)

The chart below identifies the skills and qualifications each director nominee brings to the Board. The fact that a particular skill or qualification is not designated does not mean the director nominee does not possess that particular attribute. We believe the combination of the skills and qualifications shown below demonstrates how our Board is well positioned to provide strategic advice and effective oversight to our management.

Name | | Retail Experience | | Technology or eCommerce Experience | | Global or International Business Experience | | Marketing or Brand Management Experience | | Senior Leadership Experience | | Regulatory, Legal or Risk Management Experience | | Finance, Accounting or Financial Reporting Experience | Cybersecurity | |||||||||||||||||

Robert E. Price | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

Sherry S. Bahrambeygui | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||

Jeffrey Fisher | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||||

Gordon H. Hanson | ✓ | |||||||||||||||||||||||||||||||

Beatriz V. Infante | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

Leon C. Janks | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

Patricia Márquez | ✓ | ✓ | ||||||||||||||||||||||||||||||

David N. Price | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||

David R. Snyder | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||

John D. Thelan | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||||||||

Edgar Zurcher | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||||||||

In August 2021, the SEC approved a Nasdaq Stock Market proposal to adopt new listing rules relating to board diversity and disclosure. As approved by the SEC, the new Nasdaq listing rules require all Nasdaq listed companies to disclose consistent, transparent diversity statistics regarding their boards of directors. The Board Diversity Matrix below presents the Board’s diversity statistics in the format prescribed by the Nasdaq rules.

Board Diversity Matrix (As of November 30, 2023) | ||||

Total Number of Directors | 11 | |||

| Female | Male | |||

Part I: Gender Identity | ||||

Directors | 3 | 5 | ||

Did Not Disclose Gender Identity | 3 | |||

Part II: Demographic Background | ||||

Hispanic or Latinx | 2 | 1 | ||

White | 1 | 4 | ||

Two or More Races or Ethnicities | 2 | |||

Did Not Disclose Demographic Background | 3 | |||

Directors with Disabilities: None Directors who Identify as Middle Eastern: 1 | ||||

| 8 | PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement |

Proposal 1 Election of Directors (continued)

Independent Directors

The Company’s Board of Directors has determined that the following nominees for director are “independent” under the Nasdaq Stock Market listing standards applicable to the Company: Jeffrey Fisher, Gordon Hanson, Beatriz Infante, Leon Janks, Mitchell Lynn, Patricia Márquez, Robert Price, David R. Snyder, John D. Thelan and Edgar Zurcher.

Information Regarding Nominees

The table below indicates the name, current position with the Company and age as of November 30, 20202023 of each nominee for director.

Name | Position | Age | ||||

Robert E. Price | Interim Chief Executive Officer and Chairman |

|

| |||

David R. Snyder | Vice Chairman and Lead Independent Director | 74 |

| |||

Sherry S. Bahrambeygui |

|

|

| |||

|

|

|

| |||

Jeffrey Fisher | Director |

|

|

| ||

Gordon H. Hanson | Director |

|

|

| ||

Beatriz V. Infante | Director |

|

|

| ||

Leon C. Janks | Director |

|

| |||

Patricia Márquez | Director | 58 | ||||

David N. Price | Chief Transformation Officer and Director | 34 | ||||

John D. Thelan | Director | 75 |

| |||

Edgar Zurcher | Director |

|

| |||

|

|

| ||||

|

|

|

| |||

Robert E. Price has served as Interim Chief Executive Officer since February 2023 and has been Chairman of the Board of Directors of the Company since 1997, the position he has held since the Company’s its spin-off from Price Enterprises, Inc. Mr. Pricein 1997. He served as Executive Chairman from October 2018 to February 2020. Mr. Price has served as Chief Executive Officer and President of the Company at various times during the Company’s history, most recentlyincluding as Chief Executive Officer from April 2006 until July 2010. Mr. Price was a founder of The Price Company, which operated the Price Club, and served as its Chief Executive Officer and a member of its board of directors from the time of The Price Company’s founding in 1976 until The Price Company’s merger with Costco Wholesale Corp. in 1993. Mr. Price was Chairman of the Board of Price/Costco, Inc. from October 1993 until December 1994 and Chairman of Price Enterprises from July 1994 until September 1997. Mr. Price currently serves as a Manager of The Price Group, LLC and as Chairman of the Board Directors and President of Price Philanthropies Foundation and the Allison and Robert Price Charities.Family Foundation. Price Philanthropies is a private family foundation that supports charitable activities in the Company’s markets and San Diego, California. Mr. Price is David N. Price’s father. Mr. Price is also serves as President of the Aaron Price Fellows Foundation, the sponsor of the Aaron Price Fellows Program. Mr. Price’s 44-year47 years of experience in the warehouse club merchandising business as well as his extensive knowledge of the Company’s business, history and culture, support the Board of Directors’ conclusion that he should serve as a director of the Company.

Sherry S. BahrambeyguiDavid R. Snyder has served as Chief Executive Officer since January 2019, after serving as interim Chief Executive Officer from November 2018 to January 2019. She also has been a directorLead Independent Director of the Company since November 2011. She served asMay 2023, Vice Chairman of the Board from October 2016 to October 2017. Ms. Bahrambeyguiof Directors since February 2022 and as a director since February 2021. Mr. Snyder has served as a senior counsel at Pillsbury Winthrop Shaw Pittman LLP since 2018 and previously served as Presidenta partner from 1993 until 2017 in the firm’s Corporate and Managing Member of The Price Group, LLC, an investment management firm, from September 2006 to January 2019. Additionally, Ms. BahrambeyguiSecurities practice. During 25 years as a partner, Mr. Snyder also served as Executive Vice President, SecretaryPillsbury’s executive vice-chair for two years and Vice Chairman ofon the Boards of Price Charities, Price Philanthropies Foundationfirm’s managing board for 15 years. Mr. Snyder has been a practicing attorney for over 40 years, focusing on corporate finance, and the Aaron Price Fellows Foundation, and as the Chief Executive Officer of PS Ivanhoe, LLC,has significant experience representing public companies. Mr. Snyder holds a commercial real estate investment company. Ms. Bahrambeygui was a licensed stockbrokerlaw degree from Cornell University and a partnerbachelor of arts from Michigan State University. Mr. Snyder is NACD Directorship Certified®. Mr. Snyder’s background in multiple law firms, including a founding partner in the law firm Hosey & Bahrambeygui, LLP. She practiced law with an emphasis on complex international business and corporate matters and also in the areas of employment and compensation.

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and |

Proposal 1Election of Directors (continued)

Ms. Bahrambeygui’s service as Chief Executive Officer, her experience in strategic acquisitions, her demonstrated ability to lead the Company through digital transformation and the launch of e-commerce and her thorough understanding of the business and operations of the Company contribute to the Board of Directors’ conclusion that she should serve as a director of the Company.

Mitchell G. Lynn has been a director of the Company since November 2011 and Vice Chairman of the Board since February 2020. Mr. Lynn served in several senior executive positions and as the President and a director of The Price Company prior to its merger in 1993 with Costco, Inc., and from 1993 until 1994, he served as an executive officer, director and member of the Executive Committee of Price/Costco. Mr. Lynn also was a member of The Price Group, LLC from 2005 to 2008. Mr. Lynn is a founding and continuing director of Bodega Latina Corporation, dba El Super and Fiesta Mart, a 120+ store warehouse-style grocery retailer that targets the Hispanic market in the southwestern United States. Mr. Lynn is a founding and continuing director of Origin International Inc., which is focused on recycling, redistributing and servicing waste oils. Mr. Lynn is also the founder and a partner of CRI 2000, LP, dba Combined Resources International, and Lightspeed Outdoors, LP, dba Lightspeed, which designs, develops and manufactures consumer products under various brand names for domestic and international wholesale distribution, primarily through warehouse clubs and online platforms. Mr. Lynn also is a founder and a partner of ECR4Kids LP dba ECR4Kids, which designs, manufactures, imports and sells educational/classroom products to wholesale dealers and online platforms. Mr. Lynn is a certified public accountant (inactive) and a licensed real estate broker in California. Mr. Lynn’s extensive prior experience in both the warehouse club business and general retailinglegal matters and his significant knowledge relating to financial mattersexperience with public companies contribute to the Board of Directors’ conclusion that he should serve as a director of the Company.

Sherry S. Bahrambeygui has been a director of the Company since November 2011 and served as Vice Chair of the Board from October 2016 to October 2017. Ms. Bahrambeygui served as Chief Executive Officer of the Company from January 2019 to February 2023 and as interim Chief Executive Officer from November 2018 to January 2019. Prior to her tenure as Chief Executive Officer, she served as the President and Managing Member of The Price Group, LLC, a private investment and management company, from 2007 to 2018. Before joining the Price Group, Ms. Bahrambeygui had a 15-year legal career as a litigator specializing in the health care, life sciences, consumer & retail, and real estate industries. She was the founding partner of Hosey & Bahrambeygui, LLP, a leading boutique civil litigation practice, from 1999 to 2007. In addition to her board service at the Company, Ms. Bahrambeygui has significant experience in corporate governance as a board member, trustee and attorney for numerous public, private and non-profit companies and boards. Ms. Bahrambeygui’s extensive international business, governance and leadership experience, strategic decision-making and ability to lead the Company through digital transformation and e-commerce expansion contribute to the Board of Directors’ conclusion that she should serve as director of the Company.

Jeffrey Fisher has been a director of the Company since November 2019. Since 2011, Mr. Fisher has served as the Chief Financial Officer and member of The Price Group, LLC, a private investment and management company, and Price Philanthropies Foundation, a private non-profit organization.company. He also has been Chief Financial Officer and a director of Price Philanthropies Foundation, a private family foundation working to transform the lives of youth and families through grant making and youth programs, since May 2019. Since 2004,In addition, since January 2022, Mr. Fisher has also served as CFO of the Chief Financial Officer of PS Ivanhoe, LLC,PriceSmart Foundation, a real estate holding company.California nonprofit public benefit corporation which serves as the philanthropic partner for the Company, providing grants to nongovernmental organizations focused on youth development, economic development and community and environmental resilience in PriceSmart countries. He is also Chief Financial Officer of Aaron Price Fellows Foundation, La Jolla Fay, LLC, IvanFay, LLC, and RARSD, LLC. From 2004 to 2021, Mr. Fisher served as the Chief Financial Officer of PS Ivanhoe, LLC, a private real estate holding company. From January 2004 through December 2004, Mr. Fisher served as Chief Financial Officer of Price Legacy Corporation, a publicly traded Real Estate Investment Trust with approximately $1.2 billion in real estate assets. From October 2000 until joining Price Legacy, Mr. Fisher served as Chief Financial Officer of National Retail Partners, LLC, a private real estate company which owned and operated approximately $2.0 billion in real estate assets. From August 1993 to September 2000, Mr. Fisher served in various financial capacities of Burnham Pacific Properties, Inc., a publicly traded Real Estate Investment Trust. Prior to joining Burnham Pacific Properties, Mr. Fisher was a senior manager at Deloitte & Touche LLP, having started with them in 1983. Mr. Fisher is a certified public accountant. Mr. Fisher brings over 3643 years of finance, accounting and investment experience, with an emphasis on real estate finance, and specific experience with public companies. Mr. Fisher’s extensive experience with finance and real estate matters, his experience as an executive of publicly traded companies and his accounting background contributed to the Board of Directors’ conclusion that he should serve as a director of the Company.

Gordon H. Hanson has been a director of the Company since April 2014. Mr. Hanson has been a tenured member of the faculty at the Harvard Kennedy School of Harvard University since January 2020. From 2001 through 2019, he was a tenured member of the economics faculty at the University of California, San Diego. From 1998 to 2001, he was a tenured member of management faculty at the University of Michigan, and from 1992 to 1998, he was on the economics faculty of the University of Texas. From 2009 until 2014, he served as a director of the Washington Office on Latin America, a non-profit organization working to promote civic advancement in the region, chairing their development committee. Mr. Hanson’s extensive background in the analysis of the economies of Latin America, including over 2530 years of experience in consulting for international financial organizations, contribute to the Board of Directors’ conclusion that he should serve as director of the Company.

Beatriz V. Infantehas been a director of the Company since January 2018. Since 2009, Ms. Infante has served as Chief Executive Officer of BusinessExcelleration LLC, a business consultancy specializing in corporate transformation and renewal, and since 2008 has been a limited partner in Tandem Capital, a Silicon Valley venture capital firm.renewal. From 2010 until its acquisition by

Proposal 1 Election of Directors (continued)

Infor in 2011, Ms. Infante was the Chief Executive Officer and a director of ENXSUITE

| 10 | PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement |

Proposal 1 Election of Directors (continued)

Corporation, from 2006 until its acquisition by Voxeo Corporation in 2008 she was the Chief Executive Officer and a director of VoiceObjects Inc., and from April 2000 until October 2003 she was Chief Executive Officer and President of Aspect Communications Corporation and was additionally named ChairChairman in February 2001. Since May 2014, she has served on the board of directors and as a member of the audit committee of Liquidity Services Inc., an online marketplace for retail goods and capital assets, and has additionally servedcurrently serves as its Lead Independent Director, chair of the compensation committee, since November 2015.and member of the audit committee. Since October 2017, she has served as director and chair of the compensation and member of the audit and technology committees of Ribbon Communications, a cloud communications company formed from the merger of Sonus Networks and Genband, and more recently the acquisition of ECI.ECI, and is currently chair of the compensation committee and member of its audit and technology committees. From January 2010 until October 2017, she served as director and member of the compensation committee of Sonus Networks, and additionally became chair of the compensation committee in June 2017. Ms. Infante also served on the board of directors and as a member of the Nominatingnominating and Corporate Governancecorporate governance committee of Ultratech, Inc. from July 2016 until its acquisition by Veeco in May 2017. From May 2012 until its acquisition by Broadcom in May 2015, she served on the board of directors and as a member of the compensation committee of Emulex Corporation, and additionally became chair of the Nominatingits nominating and Corporate Governance Committeecorporate governance committee in February 2014. From 1994 to 2019, she served on the Advisory Committee to the Princeton University School of Engineering and Applied Science. Ms. Infante has also served as a director of a number of privately held companies, and currently serves on the board of directors or advisory boards of private companies in the areas of cloud infrastructure, cybersecurity, intelligent automation and bank fraud detection. Additionally, Ms. Infante is a National Association of Corporate Directors Board Leadership Fellow, and in 2016 was named to the 2016 “NACD Directorship 100,” which honors the most influential boardroom leaders each year. Ms. Infante holds a bachelor of science and engineering degree in electrical engineering and computer science from Princeton University and holds a master of science degree in engineering science from California Institute of Technology. Ms. Infante’s executive leadership experience, including from her service as a chief executive officer of various companies, along with extensive operational expertise and experience in digital transformation, engineering, sales and marketing, contribute to the Board of Directors’ conclusion that she should serve as a director of the Company.

Leon C. Janks has served as a director of the Company since July 1997. He served as Vice ChairmanChair of the Board from October 2017 to October 2018 and as Lead Director from October 2018 to February 2020. Mr. Janks served as a director of Price Enterprises from March 1995 until July 1997. He has been a partner in the accounting firm of Green, Hasson & Janks LLP in Los Angeles, California since 1980 and serves as its Managing Partner Emeritus. Since December 2020, Mr. Janks has served on the board of directors of The Jewish Federation of Greater Los Angeles. Mr. Janks has extensive experience in domestic and international business, serving a wide variety of clients in diverse businesses. Mr. Janks is a certified public accountant. Mr. Janks’ experience, his significant accounting, financial and tax expertise which qualify him as an audit committee financial expert and his many years of service to the Company as a member of the Board of Directors contribute to the Board of Directors’ conclusion that he should serve as a director of the Company.

Patricia Márquez has served as a director of the Company since February 2021. Dr. Márquez was the Dean of the Joan B. Kroc School of Peace Studies at the University of San Diego (“USD”) from 2014 to 2023 and also served as Associate Provost for Academic Planning and Innovation. Dr. Márquez joined the USD Knauss School of Business in 2007 teaching courses in “Business and Society,” “Global Social Entrepreneurship,” and “Business and Social Innovation.” Her research has focused on the intersection of business and social value creation, with an emphasis on poverty alleviation through market mechanisms. Prior to joining USD, Dr. Márquez was a professor of management (1995-2007) and dean (2003-2005) at IESA, a school of business in Caracas, Venezuela. Dr. Márquez has a bachelor of arts from Bowdoin College, and received her master of arts and doctor of philosophy in socio-cultural anthropology from the University of California, Berkeley. Dr. Márquez’s executive leadership, research and academic experience and recognized expertise in environmental and social responsibility matters contribute to the Board of Directors’ conclusion that she should serve as a director of the Company.

David N. Price has been a director of the Company since February 2022. Mr. Price has been an employee of the Company since July 2017, most recently as Executive Vice President and Chief Transformation Officer. He previously held the position of Executive Vice President and Chief of Staff to the Chairman of the Board and the Company’s Interim Chief Executive Officer, Robert Price, from December 2022 to July 2023. From August 2021 to December 2022, Mr. Price served the Company as Vice President for Environmental and Social Responsibility and had previously served as the Company’s Vice President for

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement | 11 |

Proposal 1 Election of Directors (continued)

Omnichannel Initiatives and Environmental and Social Responsibility. From August 2018 to August 2020, Mr. Price was Director of Ecommerce. Mr. Price serves as President of the newly established PriceSmart Foundation, a California nonprofit corporation serving as a philanthropic partner to the Company, providing grants to nongovernmental organizations focused on youth development, economic development and community and environmental resilience in PriceSmart countries. Mr. Price also serves as Vice President of Price Philanthropies Foundation, a private family foundation working to transform the lives of youth and families through grant making and youth programs, and as Chairman of the Board of the Wildcoast Foundation, a binational nonprofit that works on coastal conservation efforts and natural solutions to climate change in Mexico and in California. In addition, Mr. Price serves on the board of the Aaron Price Fellows Foundation and serves on the Director’s Councils of The USC Price School of Public Policy and The Scripps Institution of Oceanography. Mr. Price received a Master of International Affairs from the University of California San Diego School of Global Policy and Strategy and a Bachelor of Science in Public Policy and Management from the University of Southern California. Mr. Price is Robert Price’s son. Mr. Price’s leadership in business transformation and environmental and social responsibility initiatives contribute to the Board of Directors conclusion that he should serve as a director of the Company.

John D. Thelan has been a director of the Company since February 2023. Mr. Thelan served as the Senior Vice President, Depots and Traffic for Costco Wholesale from 1992 until January 2023. During his 30 years as Senior Vice President at Costco, he oversaw the cross-dock oriented distribution network, traffic network and the ecommerce distribution network, including strategic planning, site selection, design development, material handling equipment/automation, proprietary information systems development, deployment, and enhancements, forecasting and budgeting and daily operations. Mr. Thelan has served on the Board of Visitors for Embry Riddle Aeronautical University since 2010 and the Board of Advisors for the University of Washington, Supply Chain Transportation and Logistics from 2012-2023. He has also served on the University of San Diego, School of Law Children’s Advocacy Institute since 2017. Prior to his career at Costco, Mr. Thelan served as a partner in the real estate development firm of Odmark & Thelan from 1989-1992 and partner in the law firm of Peterson, Thelan & Price, where he specialized in real estate, land use and government approvals from 1974-1989, as well as General Counsel to San Diego Metropolitan Transit Development Board and San Diego Housing Commissions. Mr. Thelan’s extensive warehouse club experience at Costco, his expertise with operations and logistics and his experience with real estate transactions contribute to the Board of Directors’ conclusion that he should serve as a director of the Company.

Edgar Zurcherhas been a director of the Company since October 2009 and also served as a director of the Company from November 2000 to February 2008. Mr. Zurcher has been a partner in the law firm Zurcher, Odio & Raven in Costa Rica since 1980, which the Company uses as counsel for certain legal matters. Mr. Zurcher is also President of PLP, S.A., as well as a director of Payless ShoeSource Holdings, Ltd. (“Payless Shoes”). PLP, S.A. owns 40% of Payless Shoes. Additionally, Mr. Zurcher is a director of Molinos de Costa Rica Pasta and Roma S.A. dba Roma Prince S.A. and is a director of Promerica Financial Corporation, S.A. Mr. Zurcher’s background in legal matters and his significant experience in Central America business and legal affairs contribute to the Board of Directors’ conclusion that he should serve as a director of the Company.

Patricia Márquez is a director nominee. Since 2014, Dr. Márquez has served as Dean of the Joan B. Kroc School of Peace Studies at the University of San Diego (“USD”), and in July 2020 she started her dual role as Associate Provost for Academic Planning and Innovation and Dean of the Joan B. Kroc School of Peace Studies. Dr. Márquez joined the USD School of Business in 2007 teaching courses in “Business and Society,” “Global Social Entrepreneurship,” and “Business and Social Innovation.” Her research has focused on the intersection of business and social value creation, with an emphasis on poverty alleviation through

Proposal 1 Election of Directors (continued)

market mechanisms. Prior to joining USD, Dr. Márquez was a professor and dean at IESA, a School of Business in Caracas, Venezuela from 2003 to 2005. Dr. Márquez has a bachelor of arts from Bowdoin College, and received her master of arts and doctor of philosophy in socio-cultural anthropology from the University of California, Berkeley. Dr. Márquez’s executive leadership, research and academic experience and recognized expertise in environmental and social responsibility matters contribute to the Board of Directors’ conclusion that she should serve as a director of the Company.

David Snyder is a director nominee. Mr. Snyder has served as a senior counsel at Pillsbury Winthrop Shaw Pittman LLP since 2018 and previously served as a partner from 1993 until 2017 in the firm’s Corporate and Securities practice. During 25 years as a partner, Mr. Snyder also served as Pillsbury’s executive vice-chair for two years and on the firm’s managing board for 15 years. Mr. Snyder has been a practicing attorney for over 30 years, focusing on corporate finance and has significant experience representing public companies. Mr. Snyder presently serves on the board of directors of Orphagen Pharmaceuticals, Inc. He also serves as an advisory board member to Atticus, Inc. Mr. Snyder holds a law degree from Cornell University and a bachelor of arts from Michigan State University. Mr. Snyder’s background in legal matters and his significant experience with public companies contribute to the Board of Directors’ conclusion that he should serve as a director of the Company.

Recommendation of the Board of Directors

The Board of Directors recommends that stockholders vote FOR the slate of nominees set forth above. Proxies solicited by the Board of Directors will be so voted unless stockholders specify otherwise on the accompanying Proxy.proxy card.

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and |

Information Regarding the Board of Directors

Board Meetings

The Company’s Board of Directors held sixfive meetings during fiscal year 2020.2023. No nominee for director who served as a director during the past year attended fewer than 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings of committees of the Board of Directors on which he or she served.

Board Leadership StructureStructure; Lead Independent Director

The positions of Chairman of theCompany’s Board of Directors anddoes not have a policy with respect to the separation of the offices of Chief Executive Officer are separate. Mr. Price serves as Chairmanand Board Chair. It is the Board’s view that rather than having a rigid policy, the Board, with the advice and assistance of the BoardNominating/Corporate Governance Committee, and upon consideration of Directorsall relevant factors and Ms. Bahrambeygui servescircumstances, will determine, as and when appropriate, whether to institute a formal policy.

In February 2023, upon the resignation of our prior Chief Executive Officer, our Chairman, Robert Price, became Interim Chief Executive Officer. The Board of Directors believes that having Mr. Price, who has served as the current leadershipCompany’s Chairman since 1997, is best situated to serve as our Interim Chief Executive Officer because of his previous experience serving the Company as Chief Executive Officer and his familiarity with the Company’s business and industry.

To ensure the appropriate level of oversight continues between our independent directors and the Interim Chief Executive Officer, the Board appointed our Vice Chairman, David Snyder, as Lead Independent Director in May 2023. As Lead Independent Director, Mr. Snyder presides over all meetings of the Board of Directors byat which the Chairman enhancesis not present, including executive sessions of independent directors; calls meetings of the effectivenessnon-management directors, as appropriate; consults with the Chairman regarding Board meeting agendas, materials circulated to the Board and the Board’s calendar; and acts as the liaison between the independent directors and the Chairman. The Lead Independent Director also serves as the Board representative to external constituents of its oversight of management and provides a perspective that is separate and distinct from that of management.the Company, including stockholders.

Role of the Board of Directors in Risk Oversight

The Board of Directors oversees the Company’s risk management processes, either as a whole or through its committees. Committees of the Board of Directors review with management and the Company’s internal audit department the Company’s major risk exposures, their potential impact on the Company’s business and the steps the Company takes to manage such risk exposures. The Board of Directors’ risk oversight process includes receiving reports from committees of the Board of Directors and members of senior management.

Committees of the Board

Audit Committee. The Audit Committee, which currently consists of Mr. Janks, Ms. Infante, Dr. Márquez and Mr. Malino, a current director not up for re-election at the Annual Meeting,Snyder, held sixseven meetings during fiscal year 2020.2023. The Audit Committee oversees the Company’s accounting and financial reporting processes and the audits of its consolidated financial statements. The Committee reviews the annual audits conducted by the Company’s independent public accountants, reviews and evaluates internal accounting controls, is responsible for the selection of the Company’s independent public accountants, and conducts such reviews and examinations as it deems necessary with respect to the practices and policies of, and the relationship between, the Company and its independent public accountants. All committee members satisfy the Nasdaq Stock Market’s standards for “independence,” including applicable audit committee independence requirements, and the Board of Directors has determined that Mr. Janks qualifies as an “audit committee financial expert” within the meaning of the applicable SEC rules and regulations. The Audit Committee is governed by a written charter adopted by the Board of Directors, which is available on the Company’s public website at www.pricesmart.com.investors.pricesmart.com.

Compensation and Human Capital Committee. The Compensation and Human Capital Committee, which currently consists of Ms. Infante,Mr. Snyder, Mr. Fisher, Mr. Janks and Mr. Malino, a current director not up for re-election at the Annual Meeting,Dr. Márquez, held sixten meetings during fiscal year 2020.2023. Each of the current members of

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement | 13 |

Information Regarding the Board of Directors (continued)

the Compensation Committee satisfies the Nasdaq Stock Market’s standards for “independence,” including applicable compensation committee independence requirements. The Compensation Committee oversees the compensation philosophy for the Company and reviews and approves the compensation program for the Company’s executive officers. The Committee is authorized to evaluate and determine the compensation of the Company’s Chief Executive Officer and reviews and approves compensation for all other executive officers.our President and Executive Vice Presidents. The Committee also administers, interprets and makes grants under the Company’s equity incentive award plans. The Compensation Committee is governed by a written charter adopted by the Board of Directors, which is available on the Company’s public website at www.pricesmart.cominvestors.pricesmart.com.

Nominating/Corporate Governance Committee. The Nominating/Corporate Governance Committee, which currently consists of Mr. Janks, Mr. Hanson and Mr. Lynn,Snyder, held two meetingsone meeting during fiscal year 2020.2023. Each of the current members of the Nominating/Corporate Governance Committee satisfies the Nasdaq Stock Market’s standards for “independence.” The Nominating/Corporate Governance Committee considers the slate of nominees to be presented for reelection at annual meetings of stockholders. The Nominating/Corporate Governance Committee also may evaluate and recommend candidates to add expertise and fill vacancies on the

Information Regarding the Board of Directors (continued)

Board of Directors, which vacancies may be created by the departure of any directors or the expansion of the number of members of the Board of Directors. The Nominating/Corporate Governance Committee approved the nomination of the candidates reflected in Proposal 1. The Nominating/Corporate Governance Committee also assists the Board of Directors as needed in establishing corporate governance guidelines and other policies and procedures pertaining to corporate governance matters. The Nominating/Corporate Governance Committee is governed by a written charter adopted by the Board of Directors, which is available on the Company’s public website at www.pricesmart.com.investors.pricesmart.com.

Executive Committee. The Executive Committee, which currently consists of Mr. Robert Price, Mr. Snyder, Mr. Janks and Mr. Lynn and Ms. Bahrambeygui,David Price, held eightfour meetings during fiscal year 2020.2023. The Executive Committee has all powers and rights necessary to exercise the full authority of the Board of Directors in the management of the business and affairs of the Company, except as provided in the Delaware General Corporation Law or the Bylawsbylaws of the Company.

Finance Committee. The Finance Committee, which currently consists of Mr. Janks, Ms. Bahrambeygui, Mr. Fisher, Mr. LynnSnyder and Mr. Malino, a current director not up for re-election at the Annual Meeting,Thelan, held sevenfive meetings during fiscal year 2020.2023. The Finance Committee reviews and makes recommendations with respect to (1) annual budgets, (2) investments, (3) financing arrangements and (4) the creation, incurrence, assumption or guaranty by the Company of any indebtedness, obligation or liability, except, in each case, for any such transactions entered into in the ordinary course of business of the Company.

Real Estate Committee. The Real Estate Committee, which currently consists of Mr. Price, Ms. Bahrambeygui, Mr. Fisher, Mr. Lynn and Mr. Zurcher, held seven meetings during fiscal year 2020. The Real Estate Committee reviews and approves the material terms of real estate-related transactions entered into by the Company, consistent with the applicable annual budget of the Company previously approved by the Board of Directors.

Digital Transformation Committee. The Digital Transformation Committee, which currently consists of Ms. Infante, Ms. Bahrambeygui, Mr. Hanson, Mr. Janks and Mr. Janks,David Price, held four meetings during fiscal year 2020.2023. The Digital Transformation Committee is charged with oversight of the Company’s omni-channel development and digital transformation to enhance membership and stockholder value.

Environmental and Social Responsibility Committee. The Environmental and Social Responsibility Committee, which currently consists of Dr. Márquez, Mr. Fisher, Mr. Hanson, Mr. David Price and Mr. Zurcher, held three meetings during fiscal year 2023. The Environmental and Social Responsibility Committee assists the Board in discharging its oversight responsibility related to environmental and social responsibility (“ESR”) matters, such as climate change impacts, energy and natural resources conservation, environmental and supply chain sustainability, human rights, employee health, safety and well-being, diversity and inclusion, public policy engagement, political contributions, corporate charitable and philanthropic activities and other ESR issues that are relevant and material to the Company and provides guidance to the Board and other Board committees on these matters.

Policy Governing Stockholder Communications with the Board of Directors

The Board of Directors welcomes communications from stockholders of the Company. Any stockholder who wishes to communicate with the Board of Directors or one or more members of the Board of Directors should do so in writing in care of

| 14 | PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and Proxy Statement |

Information Regarding the Board of Directors (continued)

the General Counsel of the Company, at the principal office of the Company, 9740 Scranton Road, San Diego, California 92121. The General Counsel is directed to forward each communication to the director or directors of the Company for whom it is intended.

Policy Governing Director Attendance at Annual Meetings of Stockholders

The Company encourages, but does not require, the members of its Board of Directors to attend the Annual Meeting. All nineten members then-serving on the Board of Directors and nominated for re-election attended the Annual Meeting of Stockholders held on February 6, 2020.3, 2023.

Environmental and Social Responsibility MattersHighlights

The Company recognizesAt PriceSmart, doing business the right way is at the core of everything we do. Our values inspire us to conduct our business with integrity, respect, and passion. Our sense of accountability and our drive for continuous improvement defines us as a company that environmentaloffers a good return to investors while conducting business responsibly, satisfying the needs of our members and social responsibility issues are of increasing importance to our investors, members, employees andsupporting the communities we serve.

For us, doing business the right way means offering our Members a valuable experience with quality merchandise and services at affordable prices, providing our employees with good working conditions, maintaining high standards of safety and cleanliness at our clubs, treating our suppliers as partners, conducting ourselves in a socially responsible manner, respecting the environment, and complying with local laws in all of the countries in which we operate. The Company is committedOur commitment to becomingour local communities includes acting as a corporate leader in environmental responsibility, and we believe that our work in the areas of environmental sustainability, social responsibility,with respect to important issues such as diversity, equity and inclusion, creates value for allhuman rights, environmental sustainability, and our employees’ well-being.

PriceSmart is committed to supporting communities in the countries in which we operate both by operating our business at the highest ethical standards and by providing philanthropic support to PriceSmart communities. In 2022, to further our philanthropic impact, PriceSmart and the Price Philanthropies Foundation established the PriceSmart Foundation to serve as the philanthropic arm of our stakeholders.Company. The core principles of the PriceSmart Foundation are promoting youth career development, supporting economic development in under-resourced communities and funding initiatives that strengthen environmental and community resilience. Some examples of the impact that the PriceSmart Foundation made in the last fiscal year include vocational training programs focused on information technology, facility maintenance, bakery and butchery and other skills. A number of the participants were able to get on the job experience through internships at our PriceSmart clubs. In addition, the PriceSmart Foundation also supported a business accelerator program in Honduras and Guatemala for small and medium sized enterprises owned by women. During fiscal year 2023, PriceSmart continued to partner with Price Philanthropies Foundation’s Aprender y Crecer program. Aprender y Crecer receives significant funding through PriceSmart member donations at the point of sale during the holiday season’s Juntos por la Educación campaign. These member donations help fund Aprender y Crecer’s donations of school supplies and books to public primary schools in the Company’s Spanish speaking markets.

Governance

Environmental and Social Responsibility (ESR) Leadership. As a way of solidifying our commitment to corporate responsibility, we have a dedicated ESR department. This team is responsible for guiding, measuring and communicating this fundamental aspect of PriceSmart’s corporate culture and strategy into all aspects of our business. Furthermore, our Board of Directors now includes an Environmental and Social Responsibility Committee.

Anti-Bribery and Corruption. In the operation of our business, we aim to perform at the highest standards of ethical behavior and business conduct and to be part of an honest and productive economic system. We have established and implemented anti-bribery and corruption practices that seek to minimize, or eliminate, any act of corruption while conducting business on behalf of the Company.

| PriceSmart, Inc. Notice of 2024 Annual Meeting of Stockholders and | 15 |

Information Regarding the Board of Directors (continued)

PriceSmart’s long-standing commitmentSustainability

Direct Farm Program. We launched our Direct Farm Program in Panama in 2018 to eliminate intermediaries in sourcing of fresh produce. Under the program, we buy fresh fruits and vegetables directly from farmers who make deliveries to our produce distribution centers. From there, we supply products to our warehouse clubs. We believe this model reduces prices, improves the lives of local, small and medium-sized farmers and allows us to obtain better, fresher and safer products for our Members, while reducing the overall handling and transportation of these products. The program has been so successful that in just a few years, we expanded from Panama to Colombia, Costa Rica, the Dominican Republic and Guatemala.

Local Purchasing and Merchandising. PriceSmart considers merchandise as being sourced locally when it is purchased within Latin America and the Caribbean, irrespective of the country within that region where it is sold to Members. Approximately 50% of our sales come from merchandise sourced locally. Procurement of local merchandise not only provides for a wide selection of high-quality goods at favorable prices, but it also offers us a means of investing in, and contributing to, our local communities and economies.

Sustainable Fisheries. In 2019 PriceSmart and Price Philanthropies Foundation partnered with the Center for Marine Biodiversity and Conservation at the world-renowned Scripps Institution of Oceanography at the University of California, San Diego to undertake an assessment of seafood sourcing for our Costa Rica warehouse clubs. In 2021, PriceSmart and Price Philanthropies renewed and expanded this partnership. The expansion aims at assessing the remainder of the Company’s seafood supply chain and identifying ways for science and industry to work together toward sustainability and conservation goals.

Recycling Collection Stations. We are installing recycling collection stations open to the local community at our warehouse club locations, with five recycling centers in operation in fiscal year 2023. We partner with recycling companies that pay people for the recyclable materials they turn in at the collection centers. As a result, these centers promote sustainability, return money to PriceSmart communities and create new jobs in our markets.

Food Bank Donations. During fiscal year 2023, we continued our partnership with the Global Food Banking Network, whereby we partnered with food banks in eight of our markets. We are working to expand our food bank partnerships in the remaining markets. When food that we purchase or produce reaches its best buy date but is still safe for human consumption, we donate it to participating food banks that, in turn, support families and organizations who are food insecure in our markets of operation.

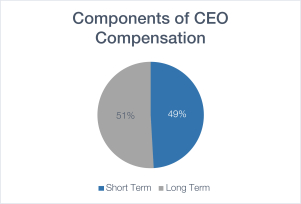

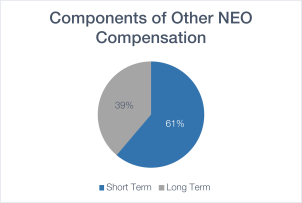

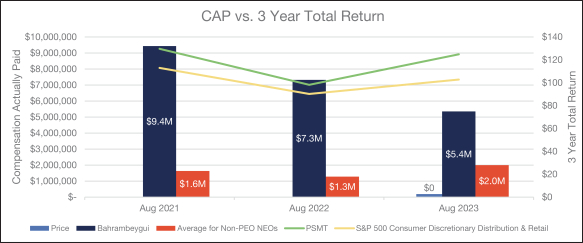

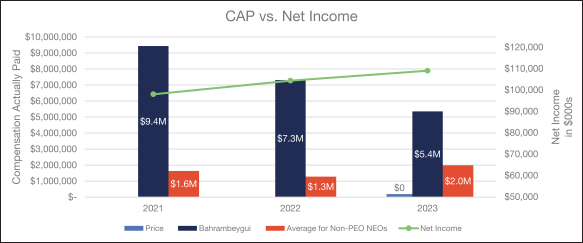

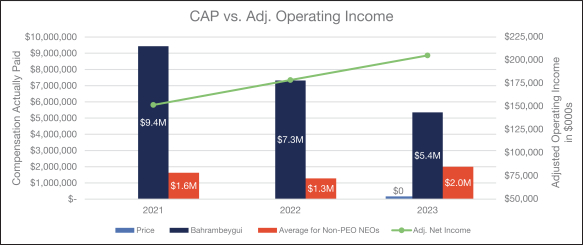

Environmental Impact